By Cecep Mustafa

JHP Journal Editor’s Note

Indonesia was promised a financial awakening.

When Fintech arrived, it came draped in utopian language—democratization, inclusion, empowerment. It promised to unshackle millions from bureaucracy and bring credit to the unbanked. The future, it seemed, could be downloaded.

Yet behind the sleek interfaces and cheerful slogans, another story unfolded: one of desperation, data theft, and digital coercion. What began as liberation has, for many Indonesians, become a quiet form of bondage.

The Double-Edged Promise

Peer-to-peer lending was meant to bypass the old gatekeepers of finance. For the first time, a street vendor in Riau or a teacher in Makassar could tap their phone and receive a loan within minutes—no collateral, no queues, no shame.

But technology does not erase inequality; it digitizes it. The same platforms that brought access also opened the floodgates to predatory lenders operating beyond the reach of law. They flourished in the cracks between innovation and oversight, feeding on the very precarity that made Fintech so attractive.

In Riau alone, over 130,000 users turned to online loans in a single year. Many had no other choice. The traditional banks, with their paperwork and collateral, had long closed their doors to those living paycheck to paycheck. Fintech opened a window—but behind that window waited the wolves.

The Price of a Click

For victims of illegal lending, the cost of a single tap can be ruinous. What begins as a modest loan—one million rupiah to cover school fees or medical bills—spirals into a nightmare of surveillance and harassment.

Data becomes a weapon. Once a borrower downloads an app, their contact lists are harvested. When payments falter, the threats begin—not just to the borrower, but to family, friends, employers. Shame becomes collateral.

The Jakarta Legal Aid Institute (LBH) has documented the pattern: impossible interest rates, phantom fees, and the digital equivalent of extortion. The Indonesian Consumers Foundation (YLKI) notes that nearly forty percent of complaints involve psychological abuse. Some victims report doctored photos and sexual threats—tactics designed not to collect debt, but to crush dignity.

This is not innovation. It is violence by algorithm.

The Guardian at the Gates

Indonesia’s Financial Services Authority (OJK) was created to prevent precisely this kind of abuse. Its mandate, under Law No. 21 of 2011, is clear: to protect consumers and ensure that financial markets serve the public good.

In 2016, OJK Regulation No. 77 established a framework for online lending—licensing, transparency, and risk management. A multi-agency task force, Satgas Waspada Investasi, now works with Bank Indonesia and the Ministry of Communication to block illegal sites and apps, often by the thousands.

Yet for every platform shut down, another appears by morning. The fight has become a digital game of whack-a-mole—reactive, endless, and fundamentally inadequate. Regulation built for paper cannot contain predators made of code.

Beyond Regulation: Toward Digital Dignity

The crisis of illegal lending is not only about money—it is about what we are willing to sacrifice for convenience. Financial inclusion, once a moral ambition, risks becoming an instrument of exploitation if not anchored in dignity and law.

To reclaim Fintech’s promise, Indonesia must move from reaction to prevention. That means licensing before launch, not punishment after harm; robust risk controls to protect the financial system from abuse; and, most of all, centering the human being—the borrower, the worker, the citizen—whose data and dreams hang in the balance.

Technology will continue to outpace the law. But law can still lead with moral clarity.

Policy Recommendations for the Judiciary: Building Digital Justice

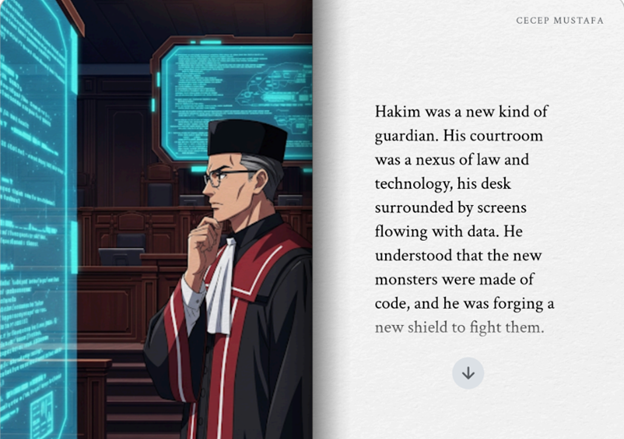

If regulators are the gatekeepers, the judiciary is the final guardian of dignity. In a financial ecosystem that moves faster than oversight, courts must evolve from passive arbiters into active interpreters of digital harm. Three steps stand out:

- Codify Digital Predation as a Distinct Offense

Illegal online lending should not be prosecuted merely as fraud or defamation, but as a unique form of digital coercion. The judiciary can help crystallize jurisprudence around privacy violations, psychological abuse, and algorithmic exploitation, ensuring the law recognizes the human cost of technological abuse. - Establish Specialized Fintech and Cyber-Justice Chambers

The complexity of digital finance demands judicial expertise. Dedicated benches or specialized divisions—trained in data forensics, digital evidence, and financial technology—would enable faster, more precise adjudication. This specialization can set a precedent for integrating digital literacy into legal reasoning. - Institutionalize Restorative Remedies for Victims

Justice must go beyond punishment. Courts can pioneer restorative mechanisms—mandating digital data erasure, debt forgiveness, and psychological rehabilitation as part of sentencing. This reaffirms that justice in the digital age must restore dignity, not merely enforce penalty. - Forge a Judiciary-Regulator Nexus

A structured liaison mechanism between the judiciary, OJK, and Satgas Waspada Investasi can ensure faster case referrals, evidence sharing, and cross-agency coordination. Such integration would make the legal system both preventive and responsive, bridging the gap between enforcement and adjudication.

Epilogue: The Moral Code

Indonesia’s financial future will not be written only in lines of code but in the moral choices of its institutions. The judiciary, more than any algorithm, defines the boundaries of fairness. Fintech may have digitized finance, but justice must digitize compassion.

Only when law reclaims that ground—firm, humane, and awake to the new architectures of harm—will the promise of financial freedom truly belong to all.

Untuk Mendapatkan Berita Terbaru Suara BSDK, Follow Channel WhatsApp: SUARABSDKMARI